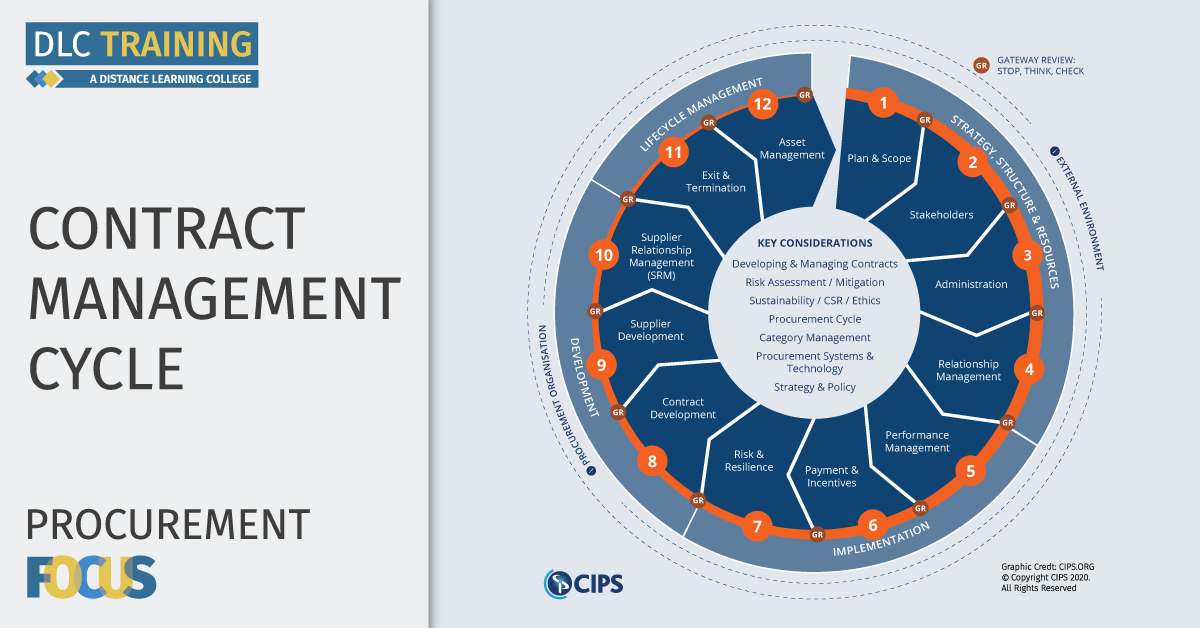

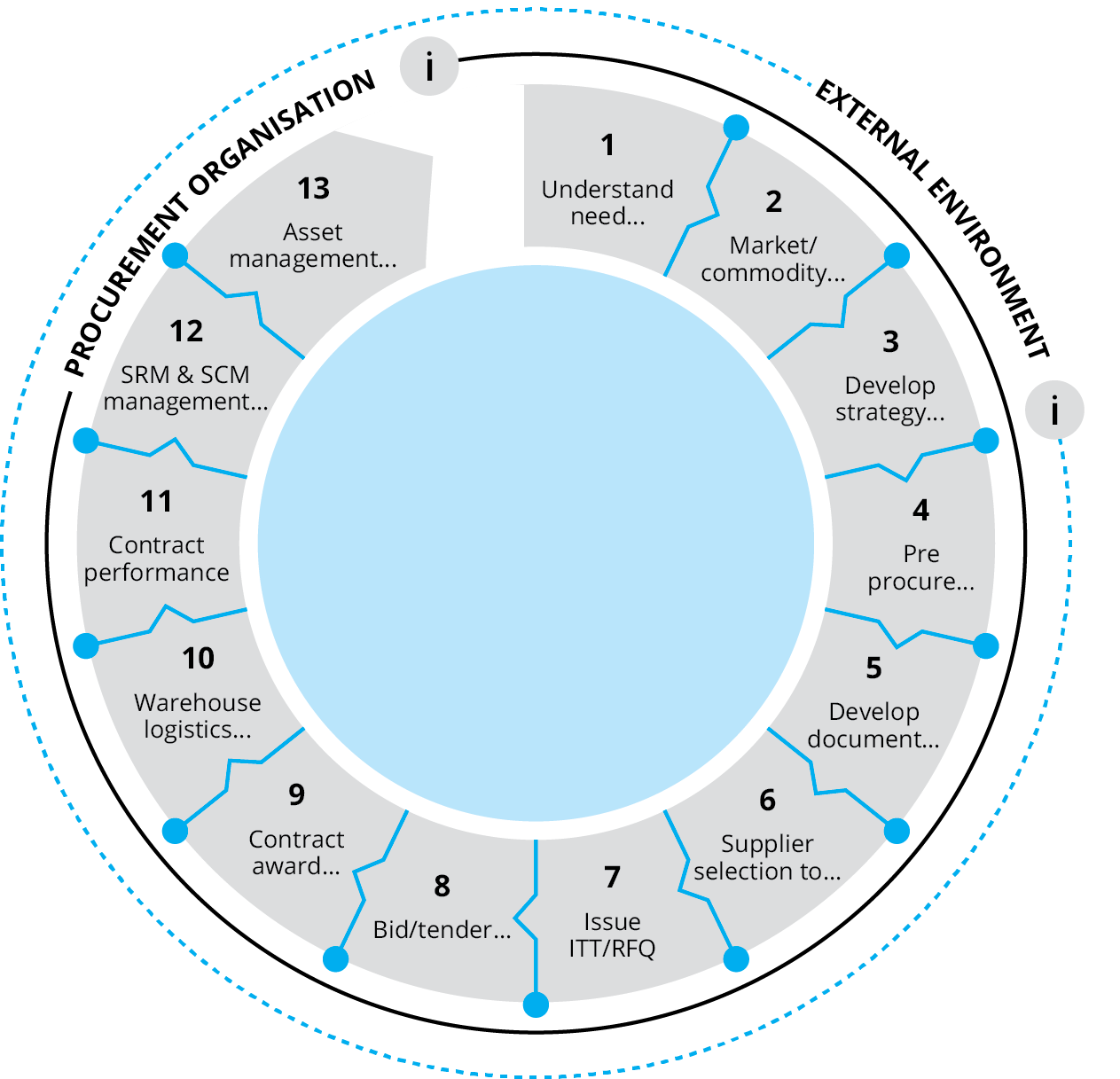

Most types of procurement, whether direct or indirect, can follow the CIPS 13 stage Procurement cycle. In the latest instalment of DLC’s Procurement Focus, Head CIPS Tutor John Little examines the Procurement Cycle and explains the importance of one key part of the cycle; 5 key stages within the sourcing process.

The Procurement cycle is covered extensively within the CIPS Foundation Diploma (level 4), however CIPS recently shared the overview of the cycle with their members to highlight the importance each part plays in successful procurement. As part of Procurement Focus we have taken a closer look at the cycle and explain why it is important for a procurement professional to follow these guidelines.This 13 stage process is an excellent way to ensure that you do not miss any vital stages in any major procurement decision.

Stage 1 Understanding the need and developing specifications

At this stage is important that the procurement team fully understands what is required by their customer (internal or external) and then translates that need into a fully comprehensive document that any potential supplier can understand and therefore quote on.

The need is normally communicated from the customer (internal or external) to the procurement team by paper requisition, electronic means or verbally. Whatever method that is chosen it is vitally important that the buyer knows that the customer has the authority to request and authorise any purchase.

Any request should have the basic information within it and should follow the basic 5 rights of Procurement

- Description of what is required

- Quality of what is required

- Quantity of what is required

- Delivery time of what is required

- Place of where it is required

Within the description, there should be a comprehensive specification which can be either performance or conformance type.

- Performance Specification is an outcome–based specification focusing on what outcomes are required by the buyer rather than specifying what should be delivered. A performance specification will outline what needs to be achieved (the outcome), and the supplier capabilities required to achieve that outcome but the process and inputs are left to the supplier to determine. Performance specifications outline what the product/service is to do which will include any tolerances or what the product should achieve; this could mean that the supplier is free to choose the materials of manufacture or the manufacturing process as long as it meets or exceeds the performance specification. Performance specification can be simple to prepare and allows a wider range of supplier competition which in turn could drive down prices.

- Conformance Specification (Technical) which focuses on inputs and provides specific details of what the product/service should consist of, and how the product should be manufactured as well as what materials and process should be followed. An example would be a recipe for a food product or a chemical formula. Conformance Specifications are normally a long drawn out specialist document which is costly and takes time to prepare

Following this step ensures quality standards are met and reduces the need for requotes due to lack of information or misinterpretation and therefore saves time and money for the buying organisation.

Stage 5 Developing contract / documentation

After stage 1 – 4 of the CIPS procurement cycle have been completed (covered in detail in level 4 Diploma) stage 5 involves preparing the relevant documentation to send out to potential sources as either a request for quotation RFQ or an invitation to tender ITT. Any RFQ or ITT should include as a minimum the following

- Description of what is required – The customer need

- Specification of what is required – performance or conformance

- Delivery details – time, packaging, location etc.

- Terms and conditions – There are two types of terms in a contract.

- Express terms are anything that is specifically written into the contract, e.g., payment terms.

- Implied terms are linked to legislation and regulations and are assumed to exist. Such terms do not have to be mentioned in the contract. By law, they are present even if not shown.

- Service Level Agreement (SLA)- An agreement between a buyer and supplier based on quality, delivery, availability and other measurable criteria

It is important that identical documentation is sent to every potential supplier to ensure a fair and transparent process and that results are not left to interpretation

| Request for Quotation RFQ | Invitation to Tender ITT |

| A document sent out to invite quotations | A document sent out to invite bids |

| Informal | Formal |

| Multiple suppliers not pre-evaluated | Suppliers are sometimes pre-evaluated |

| Standard regular low-cost products or services | Complex high-value products or services |

Following this step ensures potential suppliers are fully briefed on the standards required as well as the terms and conditions which eliminates early-stage suppliers that cannot conform to the requirements

Stage 6 Supplier selection

This stage requires the procurement team to decide which suppliers are to receive the ITT or RFQ. Buyers may have a pre-qualified list of potential sources, undertake site visits or audits as well as asking them to complete a pre-qualification questionnaire (PQQ) or a request for information (RFI) to gather critical information as to their suitability to perform.

A useful guideline for gathering information on potential sources can be “Carter’s 10Cs” which helps determine if a supplier meets your desired criteria

| 10 C’s | Description |

| Competency | Can the supplier supply the goods/services required to specification |

| Capacity | Does the supplier have the resources available, time, machinery, skill |

| Commitment | Will, the supplier, committed to high-quality products/services |

| Control | Is the supplier in full control of their supply chain |

| Cash | Is the supplier in a good financial position – check with credit agencies |

| Cost | Is the supplier offering a fair and competitive cost – (TCA & TCO) |

| Consistency | Is the supplier able to deliver a consistent good quality product/service |

| Culture | Does the supplier fit in with your organisations culture |

| Clean | Is the supplier environmentally friendly and ISO14001 |

| Communication | Does the supplier have the resources to communicate as needed |

Private sector organisations and the Public sector cover supplier selection and evaluation differently

- Private sector companies are unregulated about which sources they choose to work with and normally have a free hand to pick and choose the supplier they want as long as they adhere to common laws and their company’s policy and procedures.

- Public sector organisations are normally heavily regulated and have to follow the most stringent policies and procedures when looking for new sources and then evaluating any quotations or tenders. Any contract over a certain amount in the public sector must be sent to a pre-approved supplier database in many European regions.

As Public sector organisations are owned, run and paid for by governments that provide services to meet the demand of the public, they are held more accountable for how they spend the money and which suppliers they use. Public sector contracts over a certain monetary threshold have to be published in the Official Journal of the European Union (OJEU)

When all the information requested has been received, the procurement team can then begin the evaluation of potential suppliers and remove unethical, unsuitable suppliers and those in financial difficulties to then issue the ITT or RFQ

Stage 9 Contract award and implementation

Once all the quotes have been evaluated, and the successful supplier is chosen it is good practice to notify the winning supplier before notifying the unsuccessful ones, as sometimes the winning bid may have changed their minds or be unwilling to accept the contract. Once the awarding supplier has agreed to accept the contract and the contract is signed, the unsuccessful bidders can then be notified.

If an existing supplier is being replaced, it needs to be ensured that supply is continuous as the contract is transferred from the incumbent to the new supplier.

Contractual terms (terms and conditions) make up the main body of a contract document. They are referred to as the “core contract”. At a very simple level contract terms often comprise the smallest part of a contract and will not be understood without “schedules” and other supporting documentation needed in the contract.

A “schedule” to any contract is simply an appendix added to the body of the contract as a way to incorporate specific key performance indicators (KPI’s) without altering the main wording of the contract

In order for any contract to be classed as legal and binding, it must have 5 major conditions. These conditions are covered comprehensively in the Diploma level 4 section

- Offer – a full statement of what the offeror is willing to provide

- Acceptance- can only occur while the offer is open and must be absolute and unconditional

- Consideration – one thing is given in exchange for another (normally money)

- Intention – to create legal relations – both parties intend to be covered by a contract

- Capacity – legal competency – minors under 18, metal health or intoxicated people do not have capacity to enter into a contract

When the contract is signed by both parties, a legal agreement is in place, and the contract can commence.

Stage 12 Supplier performance / Supplier management

It is critical that the procurement team sets up periodical meetings with the supplier to review their performance against the KPI targets specified in the contract and address any underperformance and non-compliance and come up with good robust corrective actions to resolve any issues

Supplier Relationship Management (SRM) is an important way to monitor and evaluate suppliers. Not all contracts need to be proactively managed; only the most important ones. Not every supplier you deal with will require the same amount of time and effort. A good criterion to judge the time and effort needed is to use the “Kraljic Matrix.”

Supplier Relationship Management, or ‘SRM’, is about relationships and the evaluation and monitor of suppliers and their performance against the contract

Kraljic Matrix

| Leverage Suppliers

Vast competition Low cost to move suppliers e.g. utilities, gas-electric, phone etc.

|

Strategic Suppliers

Critical supplier to your organisation Responsible for core products |

| Routine Suppliers

Low-value items Lots of work associated with these suppliers Lots of variety available e.g. stationery, nuts, bolts etc.

|

Bottleneck Suppliers

Holds monopoly in the marketplace Little or no other options Low-value items |

Risk Impact

- Leverage suppliers normally supply high-value items used infrequently and require the buyer to build up a positive, beneficial relationship.

- Routine suppliers require little or no management, as there are lots of alternative sources available.

- Strategic suppliers need to be managed closely through regular communication and performance reviews

- Bottleneck suppliers need to be managed relatively closely as they are normally monopolies, but not to the same extent of strategic suppliers

SRM is the process for identifying all interactions with your key suppliers and then managing them in a way that increases the value from the relationship for both parties. SRM is about motivated and empowered people working in teams with key suppliers to solve problems or to deliver opportunities that create value for both parties. SRM includes four main areas which are

- Monitor performance

- Manage relationships

- Manage change

- Maintain strategy

SRM develops relationships which increase the chances of innovation, change management and trust between organisations and should benefit both parties and enable costs to be strategically managed rather than be the victims of market forces.

Today’s blog is the latest installment of Procurement Focus, a series of helpful, educational and insightful articles addresses the latest methodologies, biggest developments, and industry relevant news from across the Procurement Landscape. Click Here to visit our blog and read the other issues of Procurement Focus.

If you would like to find out more about our range of Procurement Qualifications or have any questions about which course would aid you with achieving your individual development aims speak with one of our Experts today.

| CLICK HERE TO REQUEST A CALL BACK |